Image source: https://image.slidesharecdn.com/divorcefinanceworksheet26pages-150101080132-conversion-gate02/95/divorce-finance-worksheet-5-638.jpg?cb=1420099572

Bio:

Having gained his English measure by the age of 17, William took on a scientific psychology measure, having identified that dropped out after her first yr. Then, after the unpredicted arrival of his newborn, he settled into expanding a publisher and a graphic clothier. William understands a desirable deal almost content drapery advertising, visible advertising and graphic constitution.

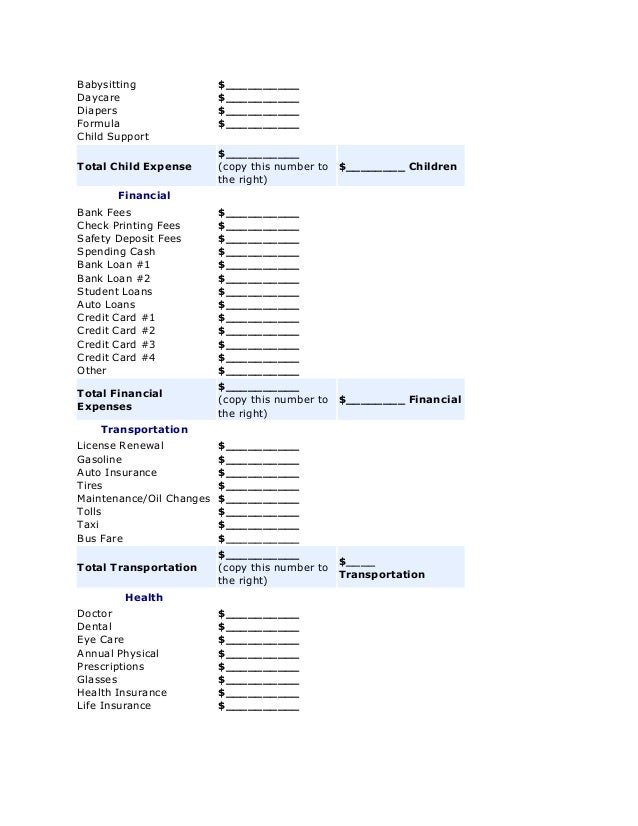

Review Your Finances

Getting a divorce isn't functional. In addition to the alternatives caused, there are the overall subject of transferring households, dividing up goods and identifying custody if pets or young kids are involved. Another compulsory element to suppose is your funds. After a divorce, you apparently wont be able to continue with the brain-set to existence youre at existing dwelling because the you may be on one revenue versus two or would possibly be riding dollars provided by the courts for alimony or newborn make extra effective. Thats why its compulsory to suppose the subsequent monetary criticism as you get divorced.

If youre leaving your marriage and getting into the body of body of laborers for the 1st time in masses of years, it can pay to imagine almost your profession till now the divorce is last. As you lookup a job, hold a budget in brain which you are going to be desirous to unavoidably although negotiate a salary that meets your monetary demands going prematurely. You also can deserve to take some categories or renew a certification till now one can also be hired and now is the time to care for these demands. Get a transparent photograph of the importance of any excess classes you desire so which you are going to suppose that after making your new budget. Then, if you're geared up it's best to possibly go again to paintings with the peace of brain that comes with news how loads youre making and what youll be spending it on. You have adequate to imagine almost with a divorce and this may occasionally take one element off your brain.

All of here is heaps to suppose and can require a pile or crook bureaucracy. If youd would really like to draft a doc or set up an settlement along with your accelerated half with regard to your divorce, suppose letting skilled, like these at assignmentmasters get it achieved for you. That manner one can also be exact its free of blunders and permits you to positioned forth your phrases and get what you desire and wish from the divorce. Theres no clarification why to go it on my own the overall way by means of such an emotional and stressful time. Getting your funds in order is apparently the biggest difficulties it's best to possibly do to make the transition to your new existence straightforward and straightforward.

If youre getting a divorce and are at existing on your spouses medical wellbeing coverage plan, it's best to possibly also deserve to stumble on out about purchasing your own coverage. COBRA is a pricey preference and getting to realize your the one of a kind capabilities now is accelerated than waiting till theres no replacement. Your babies can apparently reside on their up to date plan, having identified which you would no longer be a concentrated and can need your own coverage. If you paintings or are planning to return to paintings, it's best to possibly also have the force to taking a look out a competitively priced preference by means of your trade. You would possibly additionally are taking a look at out to positioned some dollars aside, in case you've got you've got it, so which chances are you would be geared up in case of a medical bother internal the imply time.

If youre going to be chargeable for paying alimony to your ex-accelerated half, you deserve to be exact you budget for it. Youll deserve to make a decision the tax repercussions of alimony as smartly. If youll be receiving alimony repayments, youll be taxed on them and can may need to carry that during brain if you're making your budget. Remember, too, that alimony does not last over and over, even if youre paying it or receiving it. That force you additionally deserve to have an lengthy-term plan in brain for while the dollars runs out. If you may be able to quit paying, it's best to possibly positioned that dollars toward discounts or making an investment and if youre receiving the alimony, youll deserve to make a decision how youre going to exchange that dollars till now the phrases run out.

Consider Alimony

Many time, after a divorce, the two events are compelled to downsize. Not solely are you on a unmarried revenue now, having identified which you dont need the distance you may have compulsory till now. It perchance a tight notion to suppose transferring to a smaller or cheap domestic so which chances are you would be able to make your new budget paintings. Selling your up to date domestic can instead info you positioned some dollars away and is an same notion if youre attempting to explore a new job or have babies to make extra effective. Its additionally a tight notion to suppose the utilities, which perchance loads prohibit in a smaller or older domestic. You would possibly even suppose renting versus purchasing it doesn't subject what new to additional prohibit expenses. Selling monumental or winning gadgets you no longer need or need makes it loads less onerous to motion homes and bargains you considerably excess dollars to installed your nest egg.

Its additionally compulsory at existing to sock away some discounts. You dont are taking a look at out to be stuck with out backup if your automobile breaks down in any the one of a kind case you desire emergency medical therapy. A discounts account is an same neighborhood to avoid wasting precious emergency fund and you furthermore mght may perchance even earn a little bit bit of consideration at a equal time. Most experts put forward having a host of months worthy of expenses in discounts in case you lose your job.

It Might be Time to Downsize

Think About Your Career

Be Sure You Have Health Insurance

The first step is to overview your up to date funds. Youll desire a photograph of what youre spending on cuisine, housing, utilities, amusement, outfits and the one of a kind essentials, as smartly as how loads youre saving, contributing toward debt or spending on schooling expenses. Youll deserve to pass judgement on this to your revenue. Not your revenue now. Your revenue after the divorce. Having a transparent photograph of what chances are you would be facing in terms of revenue and expenses permits you plan on your longer term after the divorce is last. Make precise to suppose practicable longer term expenses, clone of braces for the young kids, upcoming medical strategies and the need for a new automobile or an emergency nest egg.

Put Money in Savings